As the cost of living and energy prices increase in Europe and elsewhere, it is important to evaluate customer risk management strategies. Before we offer some thoughts on early recruitment strategies, we need to discuss one of the main factors driving recruitment strategies and performance today: regulation, including IFRS 9.

IFRS 9 was the latest in international accounting standards. This new standard, which began in January 2018, is designed to help lenders and banks improve their strategies and avoid unpleasant surprises through defaults, bad debts or proposed foreclosure proceedings. In the year It became a regulatory touchstone after the 2008 global banking collapse.

Until 2018, it was reported only when the defects in the accounting systems occurred. A fundamental discipline of IFRS 9 requires lenders to exercise due diligence and anticipate and plan for expected credit losses and uncollectible receivables.

IFRS 9, Collection, loss and risk strategies

In its current form, IFRS 9 divides creditors into two camps. Some saw it as an opportunity to more comprehensively and proactively examine the integration of back-office operations between sound recruiting strategies, risk and finance. Others have opted for tactical pauses to meet regulatory requirements by implementing additional manual and labor-related controls on each reporting cycle.

Any institution in the latter camp may also unwittingly limit its ability to turn regulation into an opportunity for growth and efficiency. This was an opportunity to digitize risk management, collect data breaches and activities, and enhance risk-based KPIs.

The issue of financial flexibility has returned to the forefront for all lenders given the global economic challenges we all face, from falling household incomes to inflation, rising interest rates, energy costs and a host of supply chain challenges. .

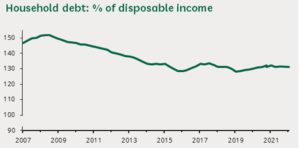

Source: Parliament Library

In the UK, the statistics speak for themselves. In the year In the second quarter of 2008, household debt as a percentage of disposable income rose 151.5 percent. In the year In the first quarter of 2022, the debt was 131.3% and against the background of the forecasts it is growing rapidly and may exceed the level of 2008.

While household spending has slowed as savings are stolen during the pandemic, consumer credit in the UK is expected to rise five-years to 8% to £16bn by the end of the year. Personal Insolvencies in England 6.5% higher than in the first quarter of 2021. In Scotland it was up 8% on a year ago.

But income classes are often affected in different ways. In July 2021, one in five households (21.6%) and the lowest income quarter reported experiencing financial difficulties. This compares to one in 17 (6%). More importantly, the gap between low- and high-income groups has widened. In July 2021, the number of reported financial issues continued to grow strongly in the first quarter, while revenue growth stalled in the fourth quarter.

Not only does real income determine consumer behavior, but consumer confidence also has a major impact. Consumer expectations about household finances have also declined significantly over the past year across all income brackets, but especially among the very poor and financially disadvantaged.

A similar picture can be seen in other European countries, but on a very different scale. For example, annual inflation in June ranged from 6.1% in Malta to 22% in Estonia.

Another reason is that it has a significant impact on customer behavior. Historically, we have seen dramatic changes in customer behavior and hierarchy as politics began to influence consumer protection arrangements following the effects of recessionary pressures on policy and customer reputation.

Seven considerations for lenders

Creditors will need to improve their collection strategies and processing capabilities as IFRS 9 becomes cost-effective.

- Regulatory scrutiny is increasing and it's all about getting the right results. Banks and lenders in the UK are looking for effective ways to comply with the new consumer obligations imposed by the FCA . There are already many compliance problems in Europe.

- Maintaining market share is very important. Lenders know that if they are not taken care of properly, they can lose good customers who may have excellent life potential. But with the wrong attitude, support, or untimely actions, they can go elsewhere. And when a customer is gone, they are usually gone forever. Banking and financial services remain highly competitive as many institutions struggle with legacy systems, biased thinking and new market disruptions, as well as profitable and competitive fintech.

- Keep a close eye on stock prices. It should always be noted that every time a client turns to debt collection, his account immediately becomes 30-60% profitable. If an account is overdrawn for more than a month, there is a direct risk of sustaining the deficiency and the deficiency remains on the creditors' balance sheet until the item is fully repaid. The systematic impact is two-fold as the credit balance component is later reported as a deemed loss, further reducing future profits.

- Connect with speed and scale for quick wins. Many more sources of real-time information and data are available, from open banking and public records to traditional credit bureaus and alternative data. The challenge is to turn all this information into useful information and take informed action.

- Many lenders still struggle to achieve a comprehensive customer-centric view From their internal data. Successful debt collection strategies are based on obtaining the widest possible amount of information, especially up-to-date information on transactions, credit utilization, income and expenses. Being able to quickly assess where and under what circumstances financial problems occur, choose the best way to communicate with the client and proactively provide appropriate support is critical.

- It is a difficult balancing act. Initial recruitment strategies are perhaps the most difficult area to properly communicate with clients. Too little, too late and the costs. Too much, too soon, and the client runs the risk of becoming overly upset or simply suspicious. Neither ends happily.

- What does "good" look like? Accurate results prevent clients from accessing collections unnecessarily. Being proactive clearly brings customer retention and regulatory benefits. But it should also be a big lever in the financial balance.

Regardless of the economic climate, high performers proactively implement a well-thought-out recruiting strategy. Safeguards are taken in the UK to prevent customers from running into permanent debt . However, other criteria include strict minimum card payments or a high debt-to-income ratio. Despite this, many lenders are not as proactive as they could be.

Forecast for the near future

The next few years won't just be about identifying the 5% of accounts that will be most likely to be collected. Pre-purchase activities should be the focus of account management teams in all portfolios.

We see organizational, political and operational blurring between customer acquisition and customer management. Customer management functions must adopt early suite strategy best practices and tolerance support functions to adopt some dynamic features, or recognize that a growing portion of their portfolio of suite functions may have a very different performance profile. Collection agencies, serving the top 20% of clients, require highly efficient and effective skills to work at a high level and flexibly.

Regardless of the impacts described in IRFS 9, it is predicted that up to 50% of consumers will soon face financial difficulties if the risks associated with ineffective collections are not proactively managed. At some point, these customers need very effective support. While there are many ways to overcome the challenges you face, it's fair to say that the best recruiting strategy is to avoid recruiting altogether whenever possible.

Bruce Curry is a senior consultant at FICO.

Post a Comment

Post a Comment